irs tax levy calculator

Abroad Tax Return. While they may employ attorneys CPAs and enrolled agents pursuant to IRS Regulation Circular 230 the use of the term Tax Attorney is used as a general or generic term referencing attorneys seasoned in aspects of tax relief and collection work.

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Consult your own attorney for legal advice.

. If the delay in filing tax return is over 60 days late the minimum failure-to-file penalty is the smaller of 435 or 100 tax due. In order to make changes corrections or add information to an income tax return that has been filed and accepted by the IRS or state tax agency you must file a tax amendment to correct your returns. Failure to pay estimated tax assessed for the failure to pay enough.

The one-half of one percent rate increases to one percent if the tax remains unpaid 10 days after the IRS issues a notice of intent to levy property. Bankruptcy Tax Discharge Date Calculator. 2022 Tax Calculator Estimator - W-4-Pro.

Method Employed by IRS tax penalty calculator. Comparison based on paper check mailed from the IRS. Failure to pay assessed for the failure to pay by the due date any taxes reported on the tax return even if its filed on time or an extension is granted.

During the registration process or later you might receive tax messages originated from IRS number 77958 or phone number. A separate agreement is required for all Tax Audit Notice Services. The scariest thing is to miss an IRS Deadline and have that Revenue Officer levy your client knowing that it was your fault.

IRS Solutions tax resolution software makes it easy. If the taxpayer in number 1 is over 65 and writes 1 in the ADDITIONAL STANDARD DEDUCTION space on Parts 3 4 5 of the levy 53655. Tax Audit Notice Services include tax advice only.

The tax resolution companies referenced herein are not law firms nor are such representations being made. The provided calculations do not constitute financial tax or legal advice. A single taxpayer who is paid weekly and claims three dependents has 50290 exempt from levy.

Failure to file assessed for the failure to file a tax return by the due date either April 15 or the date indicated in your extension agreement. Amended tax returns not included in flat fees. When you fail to pay tax due as per your return or as per the demand notice by IRS you pay failure to pay penalty.

A Power of Attorney may be required for some Tax Audit Notice Services. This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties. If you file your return by its due date and request an installment agreement the one-half of one percent rate decreases to one-quarter of one percent for any month in which an installment.

By using this site you agree to the use of cookies. If you previously opted out of receiving text messages send. Download the IRS Account Transcripts and the system will identify the earliest date taxes.

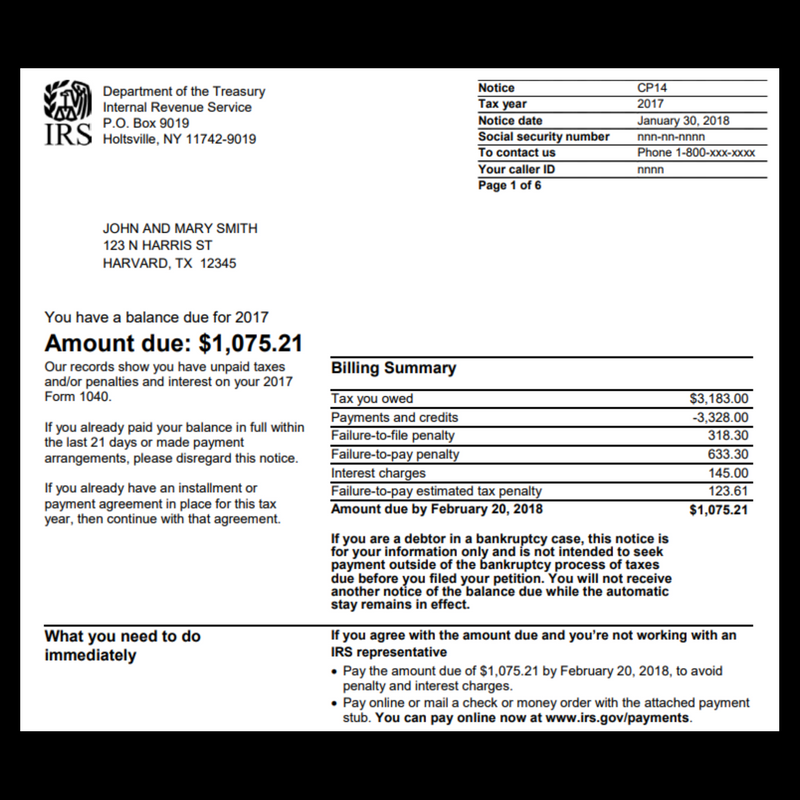

How To Handle Irs Nortice Cp14

Irs Cp134r Federal Tax Deposit Ftd Refund

Tax Attorney Tax Attorney Tax Lawyer Tax Preparation

Stop Irs Levy Now Stop Irs Wage Garnishment

Irs Notice Cp42 Form 1040 Overpayment H R Block

Irs Notice Cp503 Second Reminder For Unpaid Taxes H R Block

Irs Notice Cp49 Overpayment Applied To Taxes Owed H R Block

Irs Cp 79 We Denied One Or More Credits Claimed On Your Tax Return

What Does It Mean To Be Tax Exempted Filing Taxes Irs Taxes Accounting

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

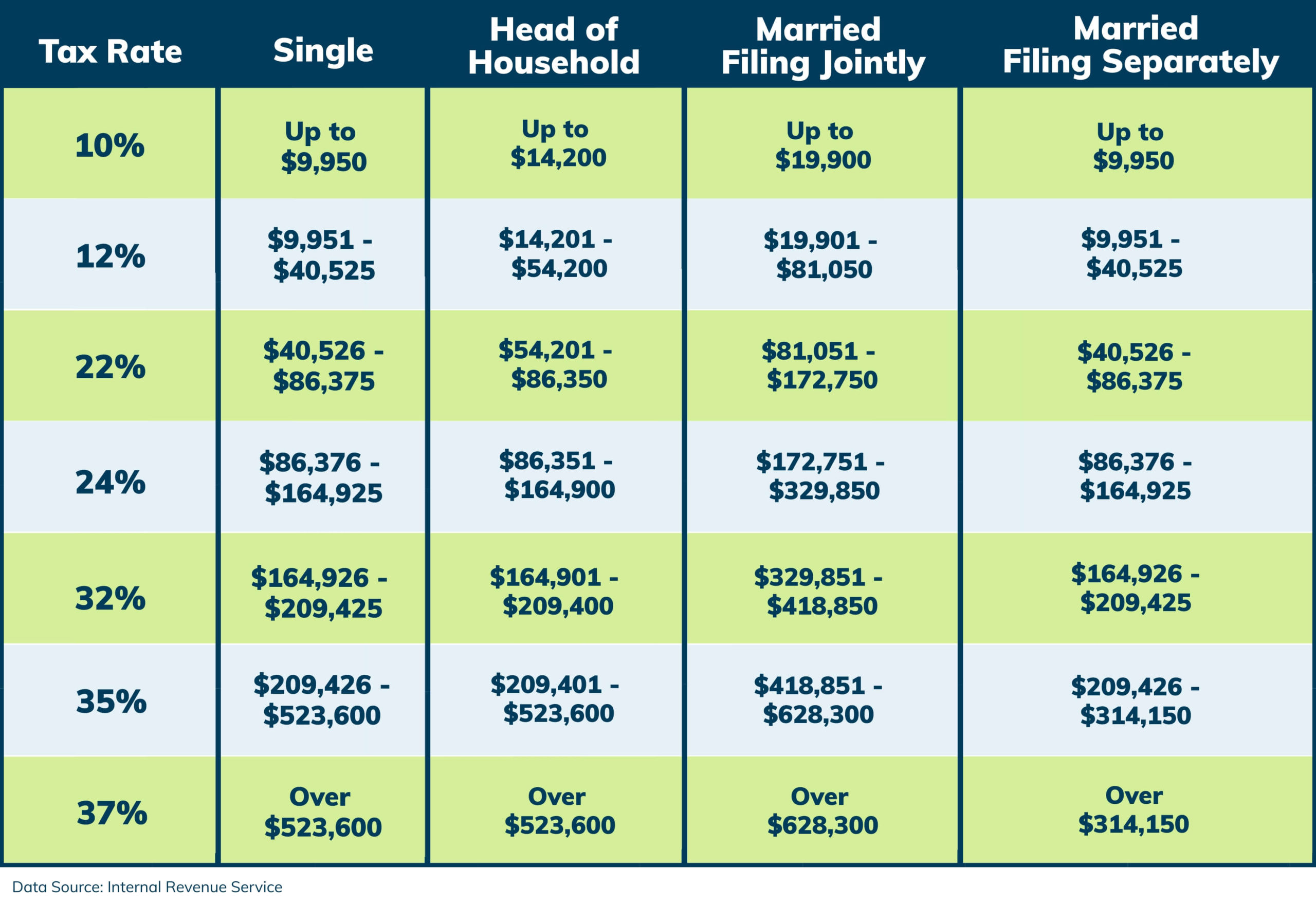

2021 Tax Changes And Tax Brackets

Irs Just Sent Me A Notice Of Intent To Seize Levy Your Property Or Right To Property Cp 504 What Should I Do Legacy Tax Resolution Services

Irs Cp 508c Notice Of Certification Of Your Seriously Delinquent Federal Tax Debt To The State Department

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

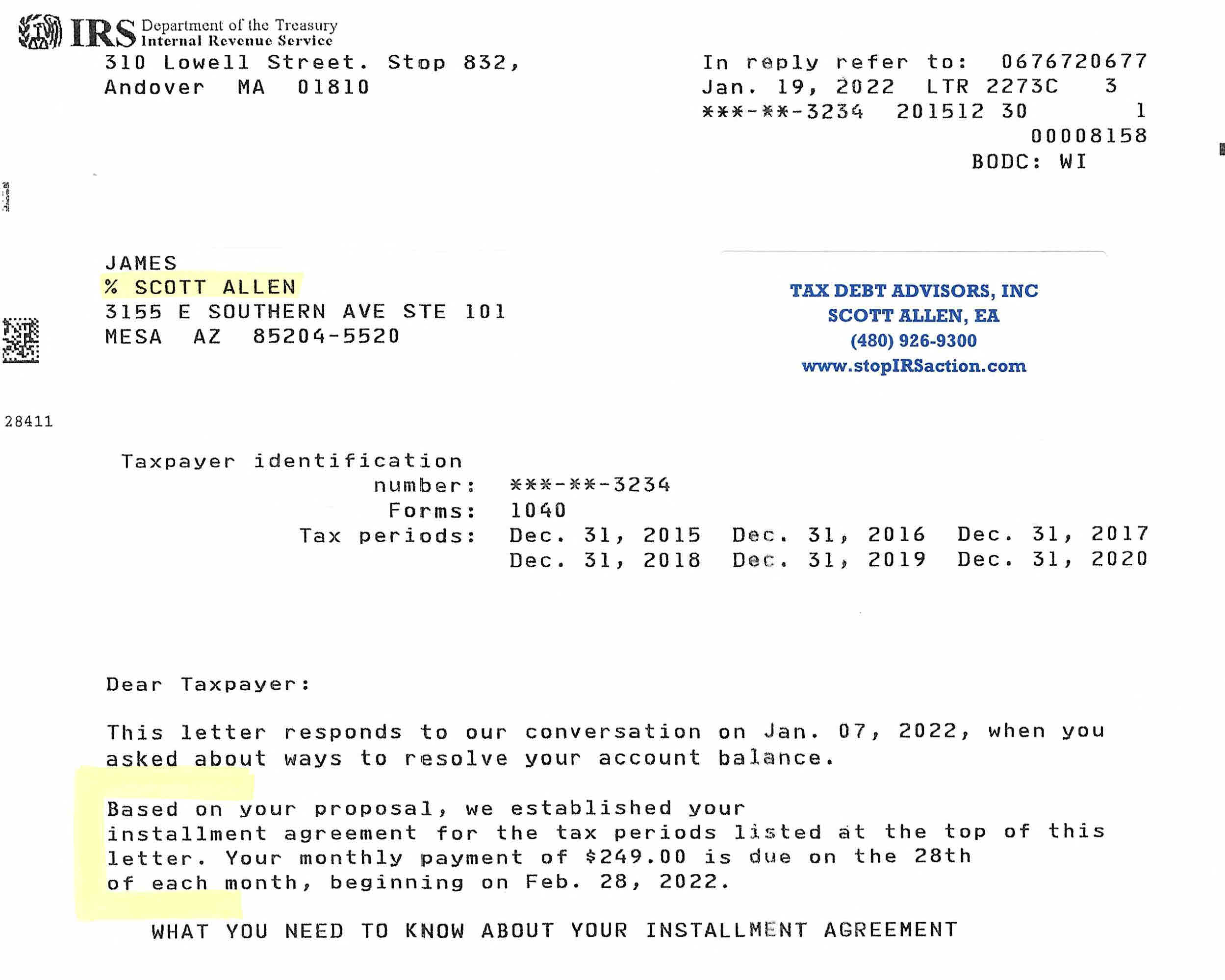

Back Tax Returns Tax Debt Advisors

Irs Tax Notices Explained Landmark Tax Group

Tax Law Attorney El Paso Tx Villegas Law Cpa Firm Irs Taxes Payroll Taxes Attorney At Law